As the year 2025 approaches, individuals with traditional Individual Retirement Accounts (IRAs) are preparing for their Required Minimum Distributions (RMDs). The RMD is a critical aspect of retirement planning, as it dictates the minimum amount that must be withdrawn from a traditional IRA each year, starting from the age of 72. In this article, we will delve into the 2025 IRA RMD table, providing insights into how it works, its importance, and the steps to take to ensure compliance.

What is the IRA RMD Table?

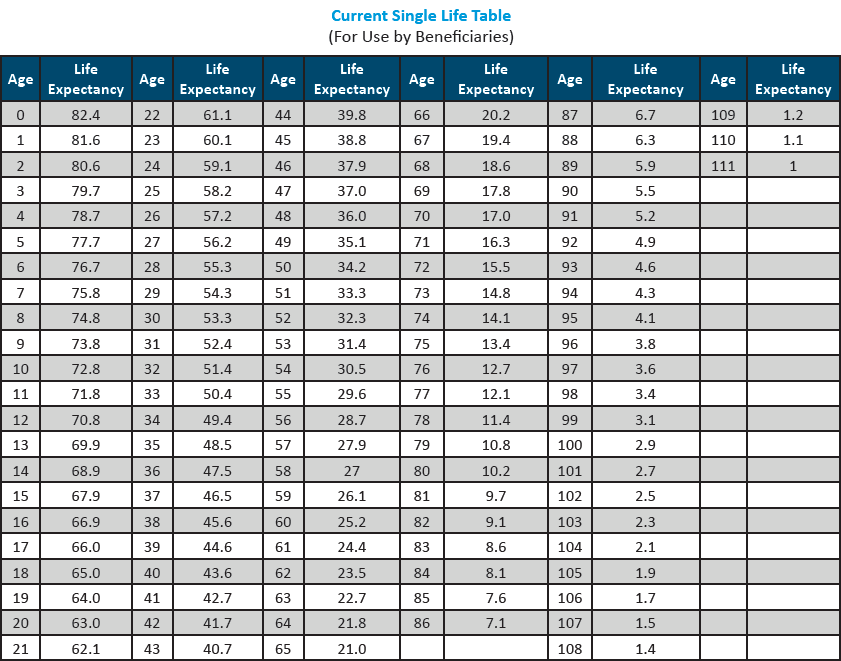

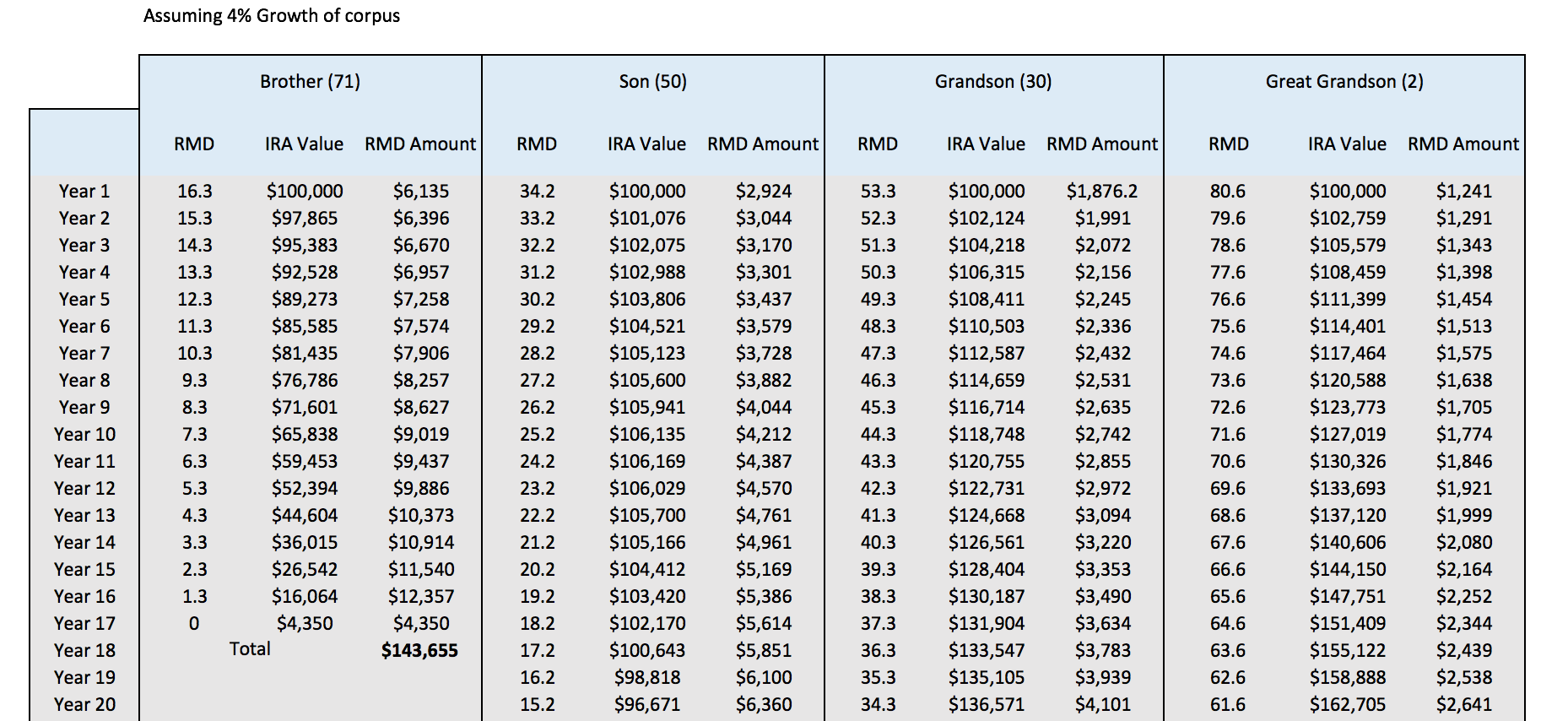

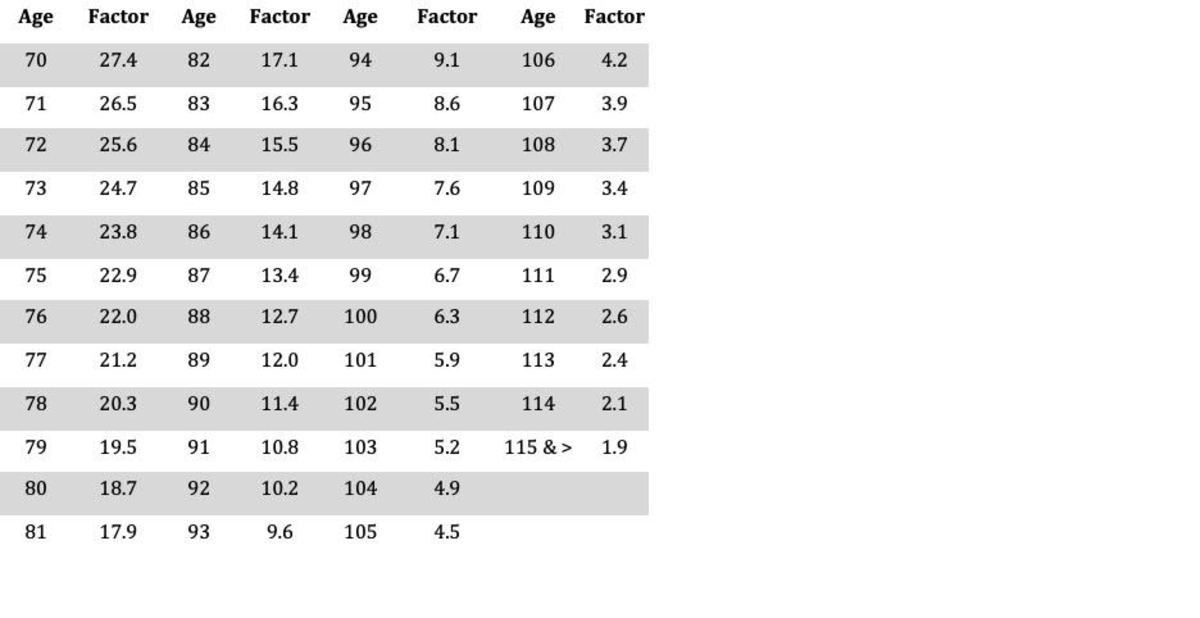

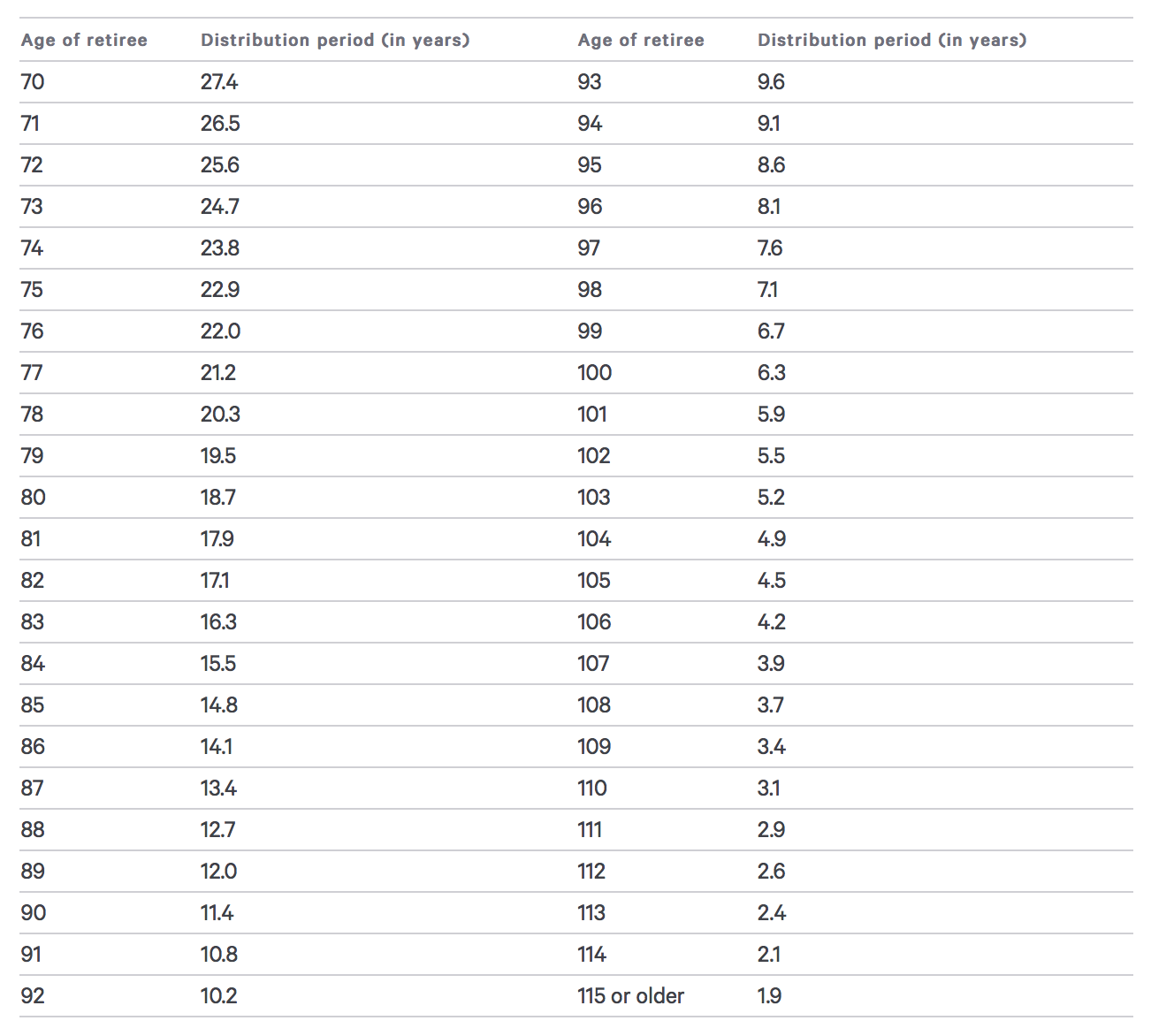

The IRA RMD table, also known as the Uniform Lifetime Table, is a chart provided by the Internal Revenue Service (IRS) that outlines the life expectancy factors used to calculate RMDs. The table takes into account the account owner's age and provides a corresponding life expectancy factor, which is then used to determine the minimum amount that must be withdrawn from the IRA each year.

How Does the 2025 IRA RMD Table Work?

To calculate the RMD for 2025, individuals will need to follow these steps:

1. Determine their age as of December 31, 2025.

2. Locate their age on the 2025 IRA RMD table.

3. Find the corresponding life expectancy factor.

4. Divide the prior year-end balance of their IRA by the life expectancy factor.

For example, if an individual is 75 years old as of December 31, 2025, and their IRA balance was $100,000 at the end of 2024, they would use the life expectancy factor of 24.6 from the 2025 IRA RMD table. Their RMD for 2025 would be $4,065 ($100,000 ÷ 24.6).

Importance of the IRA RMD Table

The IRA RMD table is essential for ensuring that individuals comply with the IRS regulations regarding RMDs. Failure to take the required minimum distribution can result in a penalty of 25% of the amount that should have been withdrawn. Additionally, RMDs are subject to income tax, so it's crucial to factor them into your overall tax strategy.

Key Takeaways for 2025

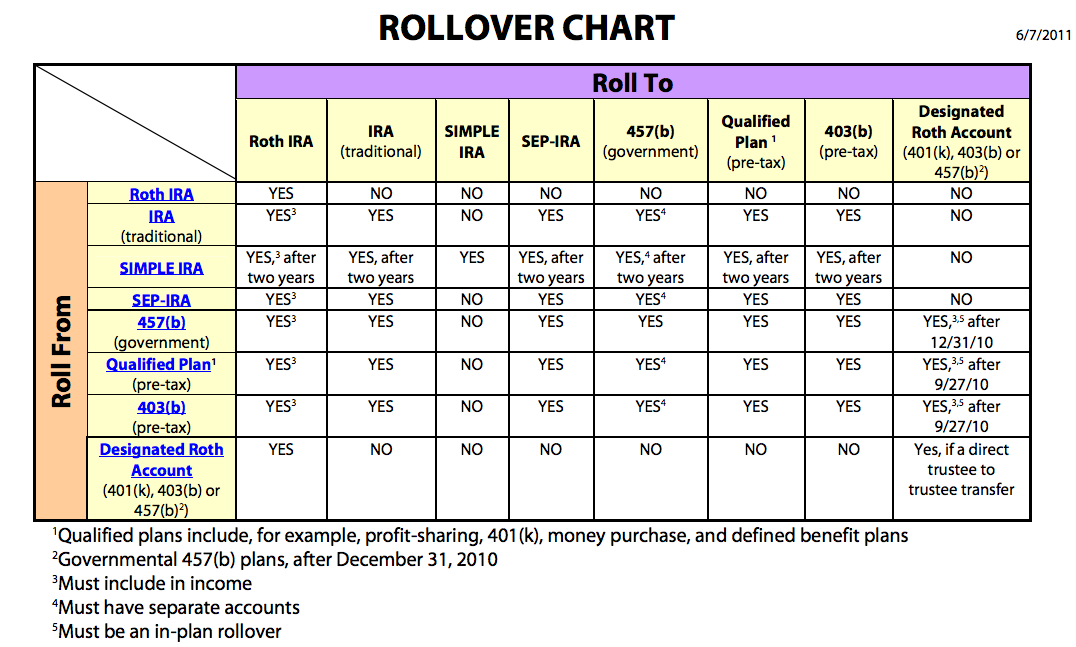

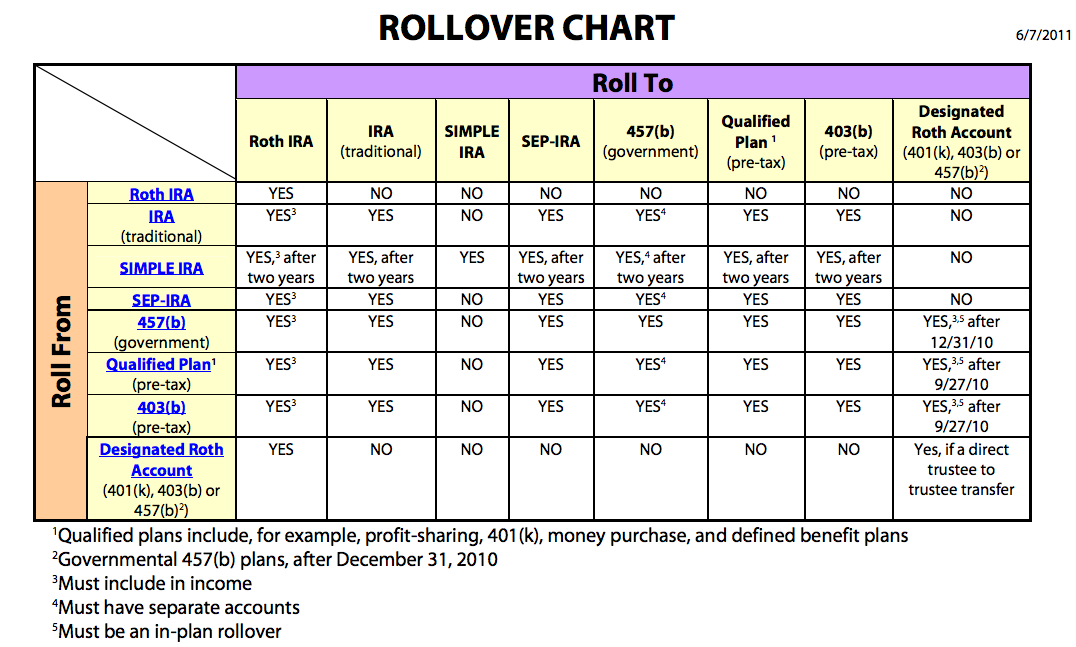

The 2025 IRA RMD table applies to traditional IRAs, including SEP-IRAs and SIMPLE IRAs.

The first RMD must be taken by April 1 of the year following the year the individual turns 72.

Subsequent RMDs must be taken by December 31 of each year.

RMDs can be taken from multiple IRAs, but the total amount withdrawn must meet the minimum requirement.

The 2025 IRA RMD table is a vital tool for individuals with traditional IRAs, helping them navigate the complex world of retirement planning. By understanding how the table works and taking the required minimum distribution, individuals can avoid penalties and ensure a steady income stream in retirement. As the rules and regulations surrounding RMDs continue to evolve, it's essential to stay informed and consult with a financial advisor to ensure compliance and optimize your retirement strategy.

Remember, the 2025 IRA RMD table is just one aspect of a comprehensive retirement plan. By staying informed and taking proactive steps, you can create a secure and sustainable financial future.

Note: The information provided in this article is for general purposes only and should not be considered as professional advice. It's always recommended to consult with a financial advisor or tax professional to ensure compliance with the IRS regulations and to optimize your individual retirement strategy.

Word count: 500

Meta Description: Learn about the 2025 IRA Required Minimum Distribution (RMD) table and how it affects your retirement planning. Understand the importance of RMDs and how to calculate them using the Uniform Lifetime Table.

Keywords: IRA RMD table, 2025 RMD table, Required Minimum Distribution, retirement planning, Uniform Lifetime Table, IRS regulations, tax strategy, retirement income.