Table of Contents

- IFTA Fuel Tax Rates: How They’ve Changed Over Five Years | TruckingOffice

- 2nd Quarter 2025 Ifta Fuel Tax Rates - Josefina Taylor

- Fillable Online tax ny IFTA, Inc. International Fuel Tax ...

- PPT - 3rd quarter - ifta tax rate changes PowerPoint Presentation, free ...

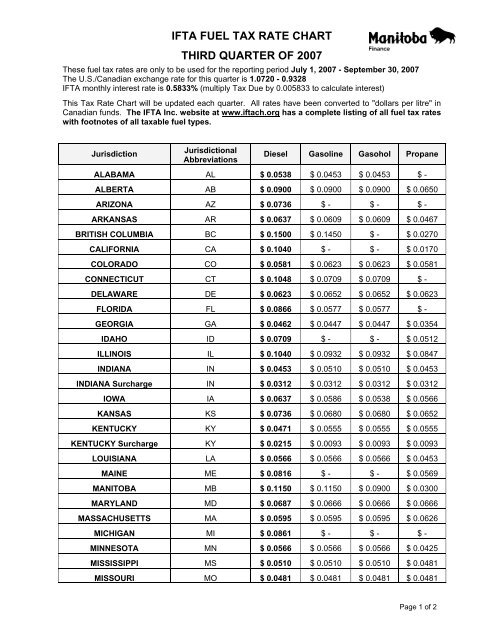

- IFTA FUEL TAX RATE CHART

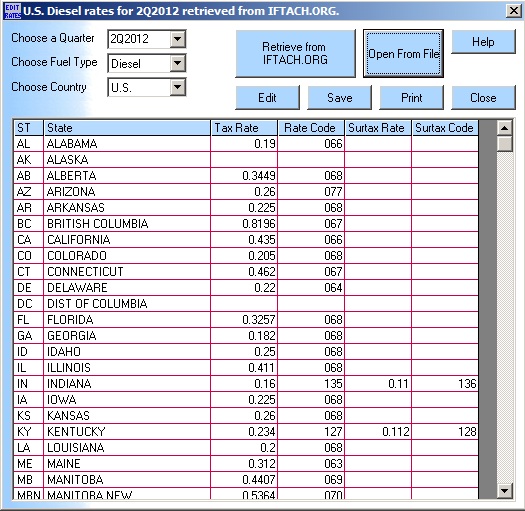

- How to Use – IFTA Reporting – My Fuel Tax

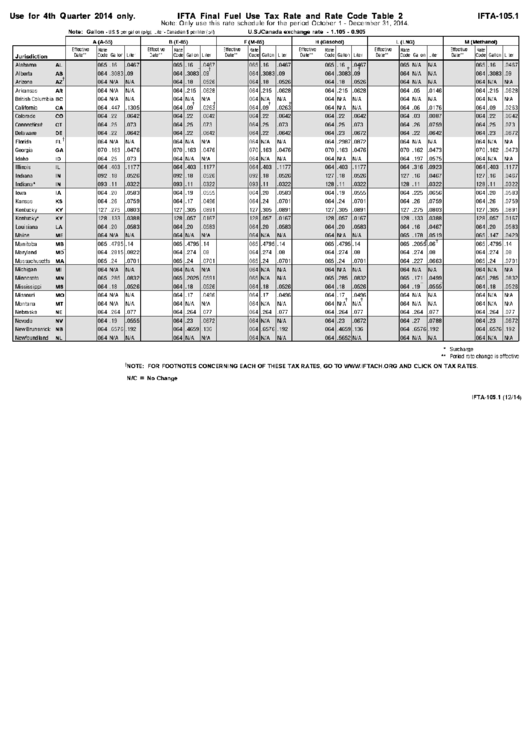

- Fillable Online Form IFTA-105 IFTA Final Fuel Use Tax Rate and Rate ...

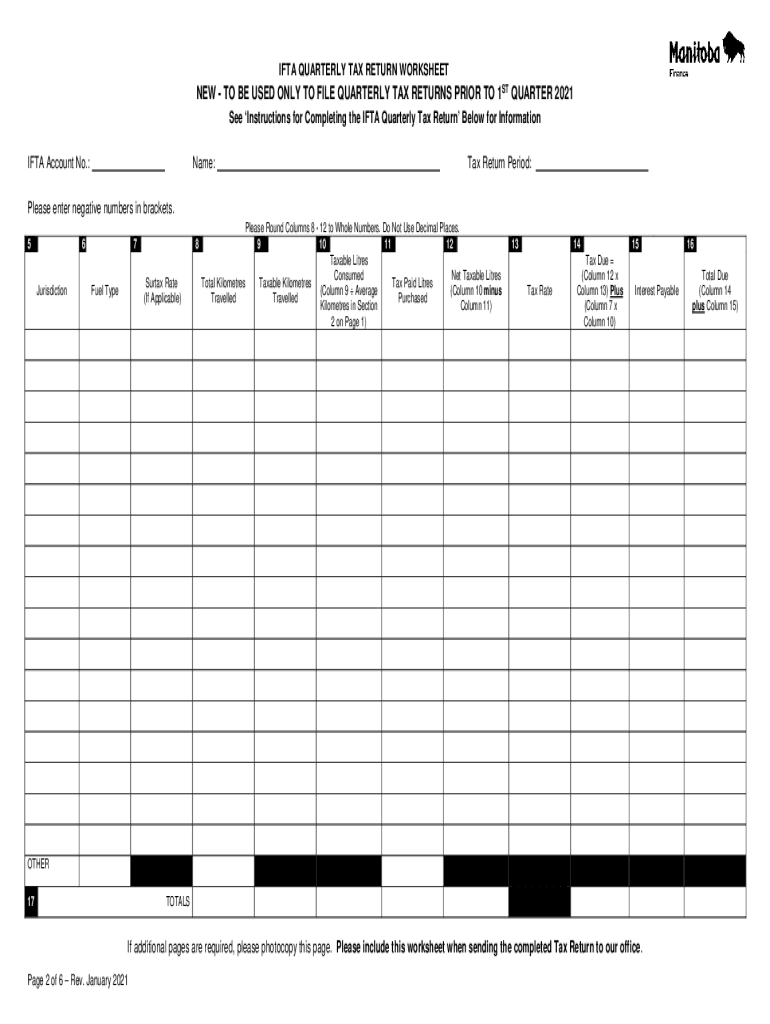

- Ifta Reporting 2021-2025 Form - Fill Out and Sign Printable PDF ...

- Ifta Nb Quaterly 2019-2025 Form - Fill Out and Sign Printable PDF ...

- Printable Ifta Forms - Printable Forms Free Online

Understanding IFTA Fuel Tax Rates

2025 GAS-1278 IFTA Fuel Tax Rates

Compliance and Reporting

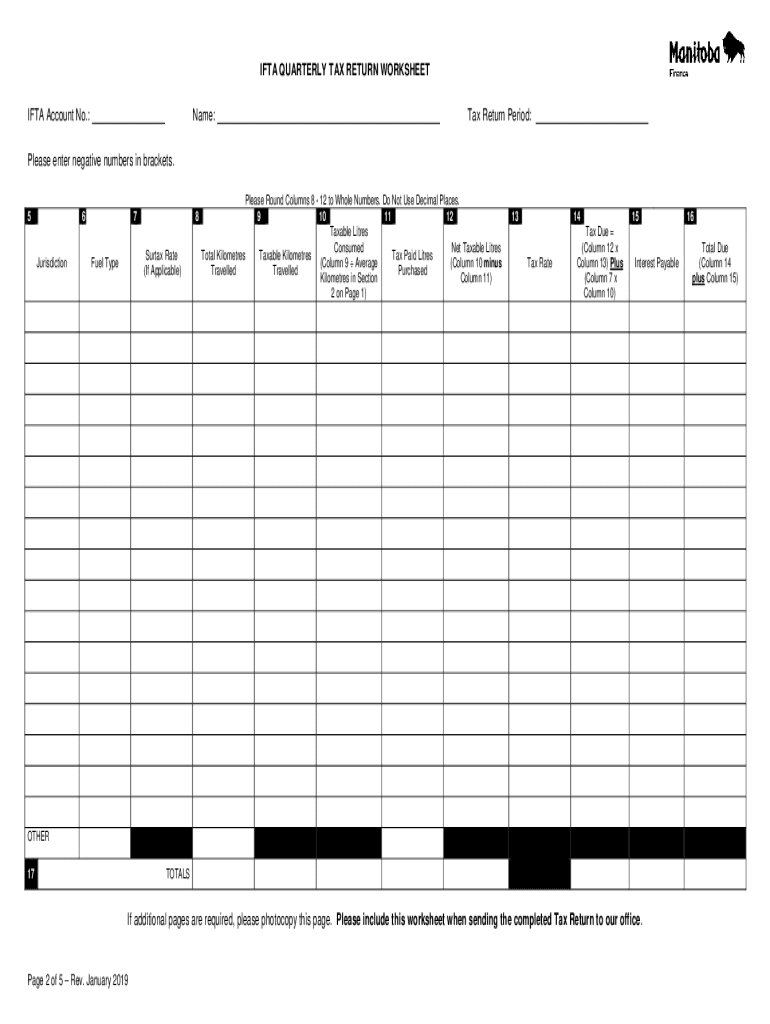

To ensure compliance with IFTA regulations, fleet owners must file quarterly tax returns and pay the required fuel taxes. The reporting period typically begins on January 1st and ends on December 31st. Fleet owners must maintain accurate records of fuel purchases, distance traveled, and tax payments. The IFTA application process typically involves the following steps: 1. Obtaining an IFTA license: Fleet owners must apply for an IFTA license through their base jurisdiction. 2. Filing quarterly tax returns: Fleet owners must file quarterly tax returns and pay the required fuel taxes. 3. Maintaining accurate records: Fleet owners must maintain accurate records of fuel purchases, distance traveled, and tax payments.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties, including fines and interest on unpaid taxes. It's essential for fleet owners to ensure they are meeting all IFTA requirements to avoid these penalties. The 2025 GAS-1278 IFTA fuel tax rates have been released, and fleet owners must stay informed to ensure compliance. By understanding the IFTA fuel tax rates, maintaining accurate records, and filing quarterly tax returns, fleet owners can avoid penalties and ensure they are meeting all IFTA requirements. Stay ahead of the game and consult with a tax professional or visit the official IFTA website for more information on the 2025 IFTA fuel tax rates.Keyword: 2025 GAS-1278 IFTA Fuel Tax Rates, International Fuel Tax Agreement, IFTA fuel tax rates, fuel tax compliance, fleet owners, IFTA application process, IFTA reporting, IFTA penalties.